Across the country, college students are working hard to achieve their academic goals while also navigating the financial pressures of tuition and daily expenses. Rising costs can create challenges, yet many students are finding ways to stay on track and build toward a bright future.

At Southeastern Oklahoma State University, supporting students in reaching academic success includes helping them identify tools and resources to make college more affordable and manageable. By building financial literacy, using available student aid resources and developing money management strategies, students can reduce stress and increase resilience.

To better understand how students experience financial stress and how it impacts their education, a national questionnaire of more than 1,000 undergraduate and graduate students was conducted on behalf of Southeastern. This report also incorporates state-level data from the Education Data Initiative, offering valuable insight into the challenges and opportunities students face today.

Key Takeaways

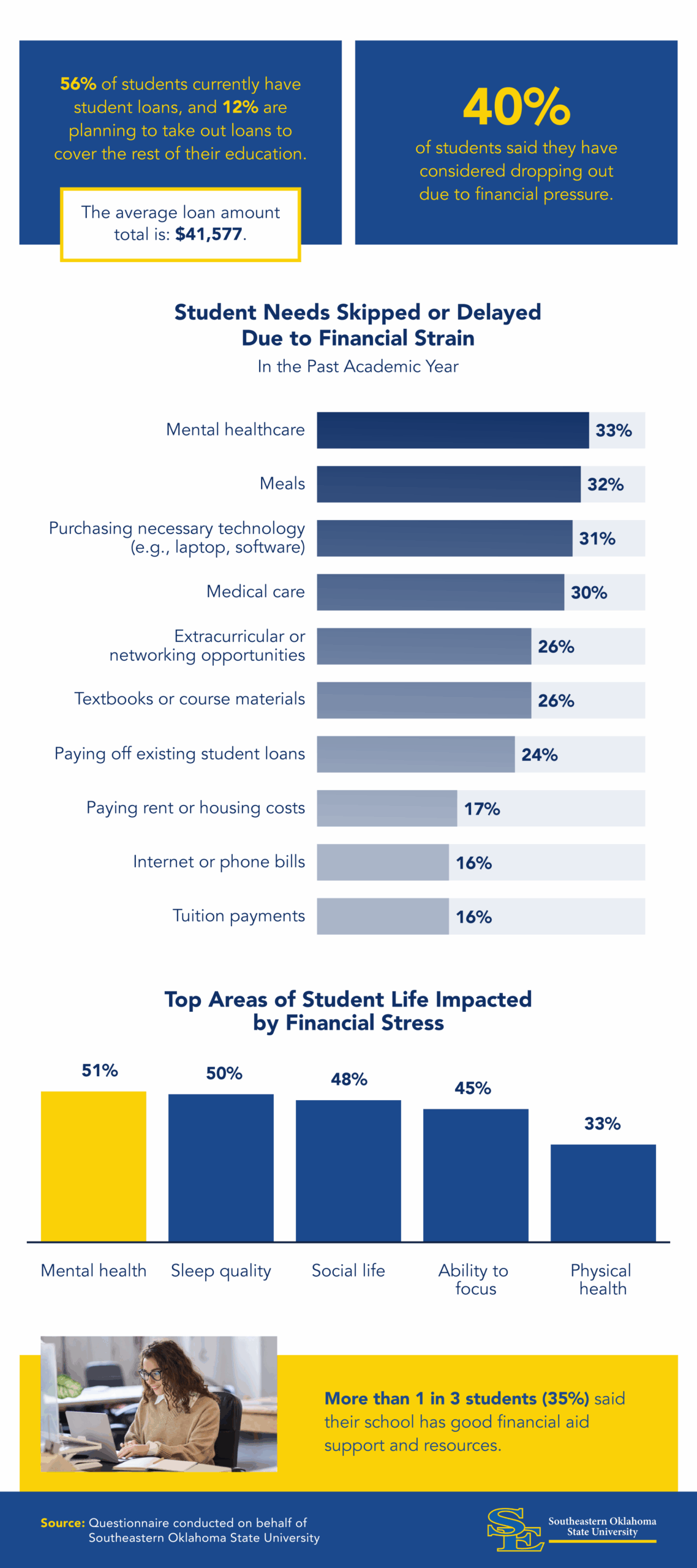

- 56% of college students currently have student loans, with an average amount of $41,577.

- On average, residents of Maryland ($43.8K), Georgia ($42.2K) and Virginia ($40.3K) have the highest average student loan debt.

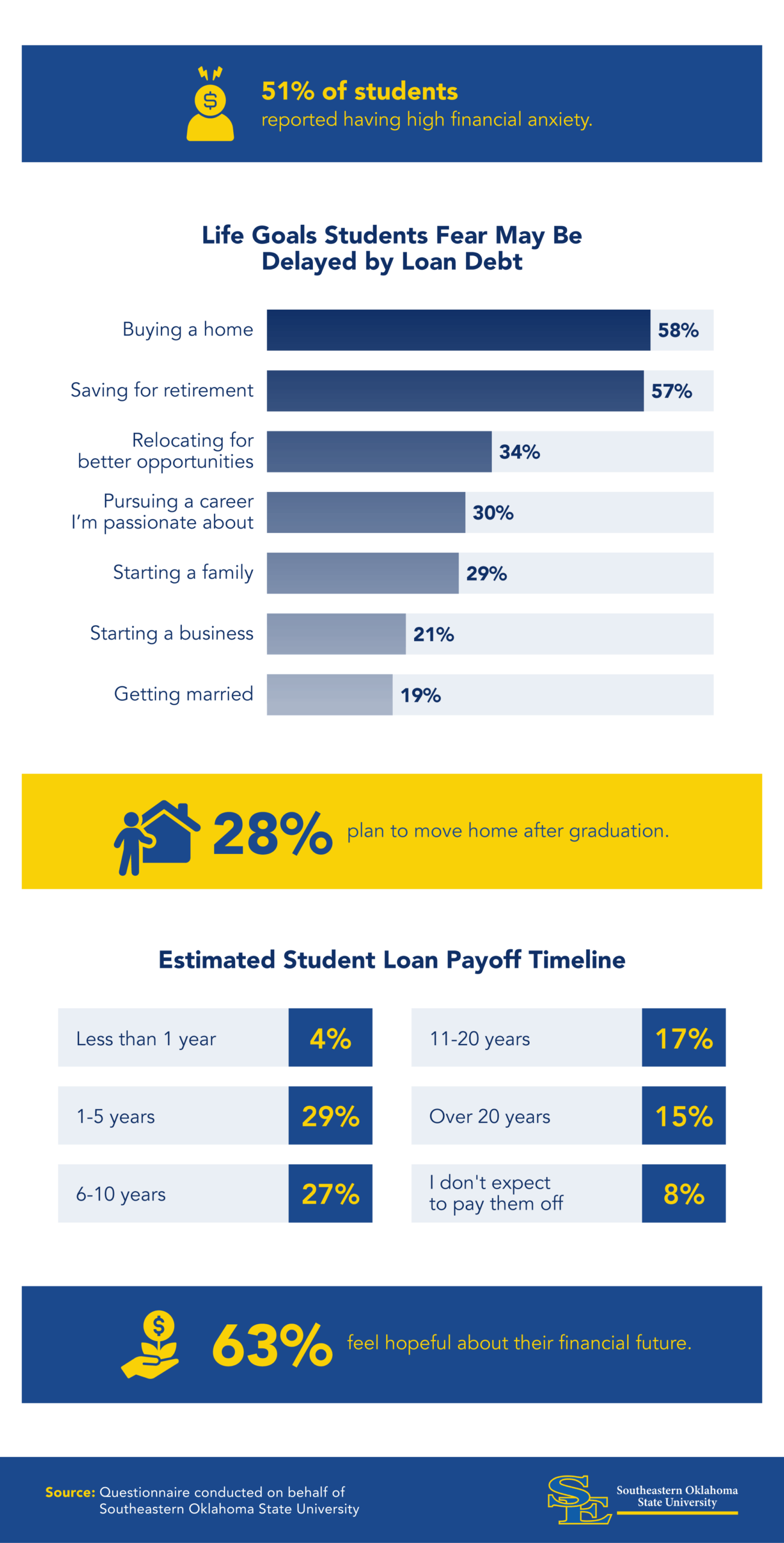

- On a scale of one to five, with one being no anxiety and five being extremely anxious, the average college student rates their financial anxiety at 3.4.

- 51% of college students say financial stress impacts their mental health, and 45% claim it affects their ability to focus.

- 63% of students are hopeful about their financial future.

- Around one in four college students (28%) expect to move back home after graduation.

The Impact of Financial Stress on College Students

Anxiety about money is affecting some students’ mental health, academic performance and their ability to cover basic needs. At the same time, students are finding ways to manage financial pressures.

More than half of college students (56%) said they currently carry student loan debt, with an average balance of $41,577. On a scale of one to five, where one means no anxiety and five means extremely anxious, the average college student rated their financial anxiety at 3.4. Over half (51%) said money worries affect their mental health, while 45% said it interferes with their ability to focus.

Financial strain has also led some into difficult trade-offs. In the past academic year, 33% delayed or skipped mental healthcare, 32% skipped meals and 31% postponed buying necessary technology. In fact, 40% said they had considered dropping out due to financial pressures.

Even so, students are actively seeking solutions. More than one-third (35%) rated their schools’ financial aid support and resources as good, while another 40% said they were fair. Students have also turned to AI tools for guidance, most often seeking advice for the following:

- Budgeting or managing day-to-day expenses

- Finding scholarships or grants

- Understanding tax-related questions

- Understanding financial aid

- Drafting or editing scholarship application essays

Although students experience financial stressors during college, small steps can go a long way toward easing financial distress and protecting well-being. Here are a few tips to get started:

- Use your campus financial aid office: This department can guide you through student aid options and connect you with valuable resources.

- Explore part-time jobs or work-study programs: Earning extra income can help cover costs while also building work experience. Paid internships are another great option.

- Practice money management with budgeting tools: Simple apps or spreadsheets make it easier to track spending and stay on top of bills.

- Start financial planning early: Building good habits now lowers the risk of having to put your education on hold because of expenses.

Students’ Financial Outlook and Concerns

Many college students are optimistic about their financial future, though some remain cautious about debt and long-term stability. This outlook reflects a mix of confidence about the opportunities a degree can bring and concern about how to manage financial responsibilities after graduation.

Sixty-three percent of students said they feel hopeful about their financial future. More than one-quarter of students (28%) said they expect to move back home after graduation to manage living expenses. This option can provide stability while helping them stay on top of student loan repayments. Students are most worried that their student loan debt will prevent them from buying a home (58%) and saving for retirement (57%).

Even with debt concerns, students can take steps after graduation to feel more secure about their financial situation. Exploring forgiveness or refinancing programs, building credit responsibly and setting savings goals can help create a stronger foundation for long-term financial wellness.

Student Loan Stats by State

Where students live can shape their financial outlook, since debt levels and borrower rates vary widely across states. Looking at geographic trends provides insight into which regions may face the greatest challenges with student loan repayment and financial stability.

Among the top 10 states by average student loan debt amount, Maryland leads at $43,781, followed by Georgia at $42,226 and Virginia at $40,287. High debt burdens can make it harder for graduate and undergraduate students to manage post-graduation finances, particularly in states where living costs are already high.

| Top 10 States by Average Student Loan Borrower Debt | |

| Maryland | $43,781 |

| Georgia | $42,226 |

| Virginia | $40,287 |

| Florida | $39,574 |

| Illinois | $39,042 |

| Hawaii | $38,929 |

| North Carolina | $38,929 |

| Delaware | $38,856 |

| New York | $38,751 |

| South Carolina | $38,715 |

Mississippi, Georgia and Ohio ranked highest for the number of student loan borrowers per 100,000 residents, with Mississippi reaching 15,448. This means that student loan repayment is likely to affect more households and communities in these states.

| Top 10 States by Number of Student Loan Borrowers per 100K Residents | |

| Mississippi | 15,448 |

| Georgia | 15,384 |

| Ohio | 15,194 |

| Louisiana | 15,011 |

| Pennsylvania | 14,429 |

| South Carolina | 14,425 |

| Connecticut | 14,287 |

| Michigan | 13,913 |

| Maryland | 13,768 |

| Minnesota | 13,759 |

Even in states with higher debt averages, students have resources to turn to. These programs are especially valuable for first-year and first-generation students, as well as low-income students who may face more barriers to enrollment and college student retention.

- Scholarships and grants: Many states and schools offer funding that reduces the overall cost of higher education and lessens reliance on student loans or credit cards.

- Campus/online advising and community resources: Guidance programs provide students with tools and advice to support student success.

- Career placement services: Connecting students with stable employment after graduation supports financial security and helps them stay on track with repayment.

- Flexible repayment plans: Spreading out payments over time reduces the risk of default and allows graduates to focus on building financial wellness.

- Repayment assistance programs: These options adjust monthly loan payments to reflect income or career path, helping graduates balance financial needs with full-time

Students who build a plan and use the support available to them are better positioned to continue their studies, avoid unnecessary stress and prepare for life after graduation.

Balancing Financial Pressure With Support

College is a big investment, and for many students, the financial pressure is real. From covering basic needs to worrying about debt, money touches nearly every part of the college experience. But with the right tools and resources, students can manage financial stress without losing sight of their goals.

Getting a handle on financial aid, planning ahead for expenses, asking for help when needed and choosing an affordable program, such as an online MBA from Southeastern, can make a real difference. This is especially true for students starting out, transferring from a community college or juggling school with work and family. Knowing where to turn for support helps students stay enrolled, manage stress and keep moving toward graduation.

Methodology

A questionnaire of 1,004 undergraduate and graduate students in the U.S. was conducted on behalf of Southeastern to examine financial stress among students. This is a non-scientific, exploratory questionnaire designed to identify behavioral and attitudinal trends. It is not intended to represent all undergraduate and graduate students or those specifically at Southeastern.

In addition, this report incorporates state-level data from the Education Data Initiative, which includes the number of student loan borrowers and the average student debt by state.

About Southeastern Oklahoma State University

Southeastern Oklahoma State University offers a range of online Bachelor’s degree programs designed to support academic success for students at every stage of their journey. With flexible scheduling and a student-focused approach, Southeastern helps learners balance education with work, family and other responsibilities.

Fair Use Statement

This content is for educational and noncommercial use only. If you share or reference this article, please link back to Southeastern Oklahoma State University and provide proper attribution.